REVAL 2026 raises concerns for hotels and accommodation sector

The results of REVAL 2026 were released by Land & Property Services, Department of Finance, providing businesses with their first sight of new Net Annual Values (NAVs).

REVAL 2026 Results Raise Serious Concerns for Hotels and Accommodation Sector

The results of REVAL 2026 were released today by Land & Property Services, Department of Finance, providing businesses with their first sight of new Net Annual Values (NAVs).

This Net Annual Value (NAV) figure will be used to calculate rates from 2026 until the next revaluation. This information was originally due to be published in November but was delayed until today, Thursday 22 January. The delay is particularly disappointing given the scale of the increases now being proposed, which will require careful and immediate budgeting by businesses.

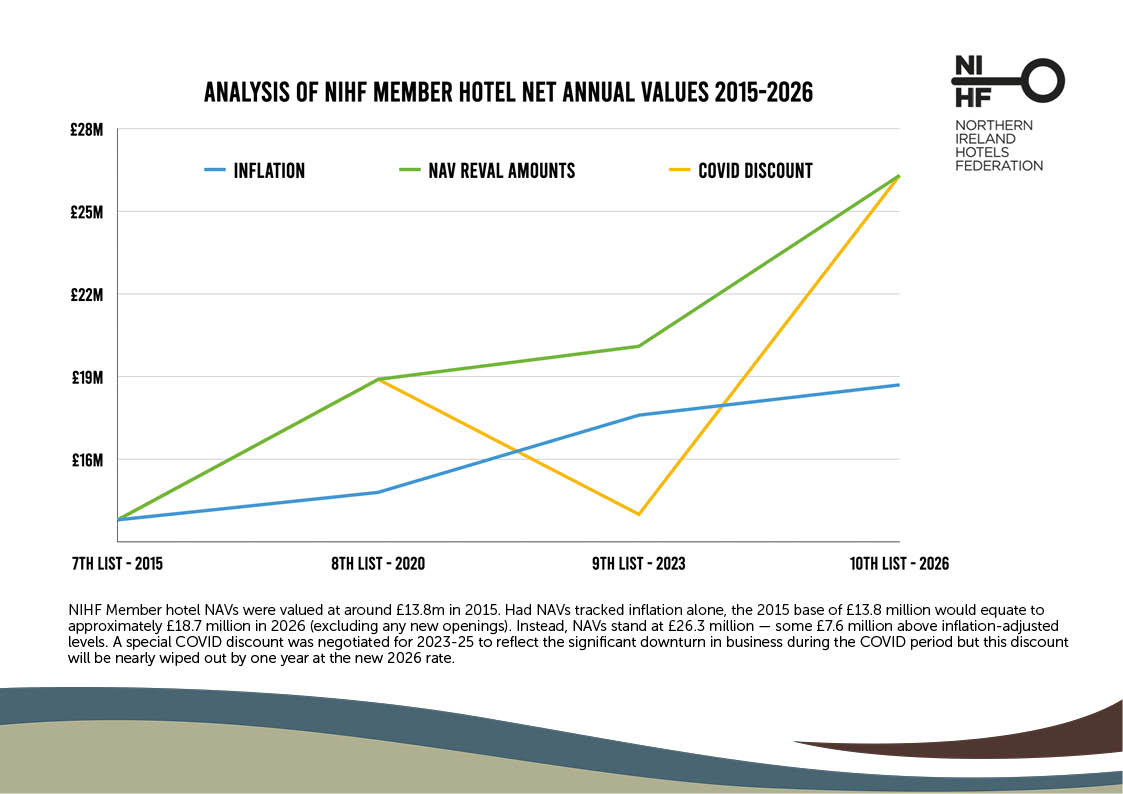

The position for the hotel and wider accommodation sector is especially challenging. Following Covid, hotels were supported through a rates discount to aid recovery and address the uniquely difficult trading conditions faced by the sector. That support has now been withdrawn, and its removal will have a profound and damaging impact on businesses.

Overall, the sector is facing an 83% increase in valuations, reflecting both the reversal of Covid support and the increased NAVs arising from REVAL 2026. The average increase for hotels is 63%, with a significant number of businesses experiencing even higher rises, taking into account material changes in their trading since the last valuation.

Janice Gault, Chief Executive of the Northern Ireland Hotels Federation, said:

“While turnover has increased, it has not kept pace with the very significant rise in operating costs. In 2025, room rates softened alongside occupancy levels, and escalating costs can no longer be absorbed by businesses alone. These pressures inevitably risk being passed on to the consumer.

“Hotels are acutely aware of the need to deliver value for money, but the sector is now being forced into an increasingly untenable balancing act.”

NAV calculations are largely based on turnover and fail to adequately reflect the substantial increases in costs experienced by the sector in recent years. In addition, the rate poundage set by local councils and the Department of Finance has yet to be confirmed and is also expected to rise, further compounding the impact on businesses.

Rates are a devolved matter, and the delay in communicating this critical information is deeply concerning. It has made forward planning and budgeting extremely difficult, particularly with new rates bills due to be issued in April. The hotel and accommodation sector currently contributes over £13 million in rates annually, a figure that is expected to rise to circa £25 million or more under the proposed new NAVs. Regional and district council poundages have yet to be agreed, adding further uncertainty.

Janice Gault added:

“There is a growing perception that the pressures facing the hotel, accommodation and wider hospitality sector are not fully understood. Many businesses feel they are being treated as a convenient source of revenue, with insufficient regard for rising costs, the need for ongoing reinvestment, or long-term sustainability. The sector’s success is being actively penalised through a short-sighted approach to an industry that has invested around £500 million since the end of the pandemic, demonstrating confidence, resilience and long-term commitment.”

The industry is calling on the Assembly to recognise the true economic value of the sector and to reflect this by moderating the scale of the proposed increases. The tourism ecosystem is complex, highly sensitive to inflation, global trends and external shocks, and requires sustained investment to remain competitive.

While the sector remains committed to supporting the local economy, there is now an urgent need for a more balanced and equitable approach to rates, and for meaningful action to mitigate the impact of these substantial increases before lasting damage is done.