Warning over interest rate hike blow to hospitality

The Bank of England’s interest rate hike to 3% “will have a serious impact on the hospitality sector here at what should be the busiest time of the year”, Hospitality Ulster chief Colin Neill has warned.

Responding to the news that will see mortgage and loan repayments soar, squeezing the wallets of industry stakeholders and customers alike, he said: “It is a worrying development. The festive season is when many of the businesses use what should be a better trading period to sustain themselves in the leaner months in the new year. Sadly this opportunity is frittering away.

“Through the joint research we have undertaken recently with our national counterparts, we know that a reduction in disposable household income, and the wider cost of living crisis, has changed people’s behaviours when it comes to going out for a meal or a drink.

“Not to downplay the impact that these wider economic factors are having on customers, the sector itself is under serious pressures in terms of steep energy prices and increased food costs. The entire hospitality industry is getting it from both ends. The interest rate hike is a hard pill to swallow at a time when we need an injection of positivity.”

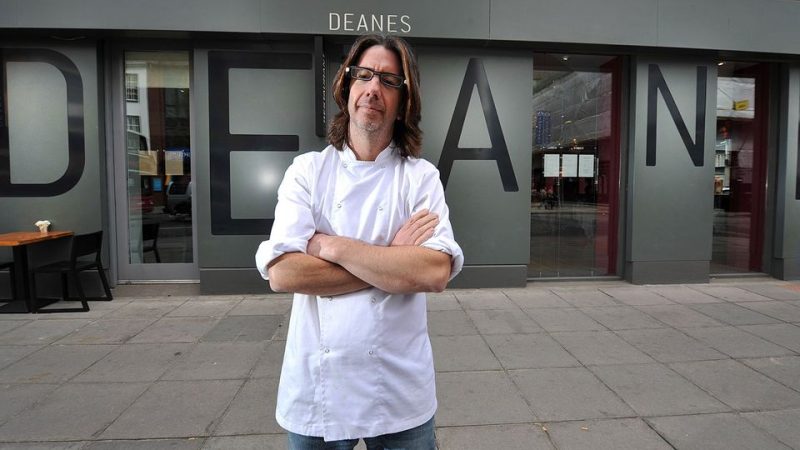

His sentiments were echoed by Michelin star chef Michael Deane who said: “With respect to the loans, 3% is quite a lot. We’ve got to try to suck it up somehow. Are the good times over? I don’t know. What next? Between gas, electric, business rates, loans, the price of food — hospitality has been kicked from pillar to post. We’re going back to Covid times and fighting fire.

“We have a few of the bounce back loans, which we had interest-free at the start for two years, but now we need to tighten up because of the [added] interest.”

Despite the mounting cost pressures on the business the owner of Eipic sais putting prices could prove even more damaging in the current financial climate.

He explained: “We have to be competitive. We’ve actually brought some of our prices down here and there to try to be competitive. It’s not just us, it’s the public. The public are worried, so we’ve probably been more competitive than we’ve ever been,” he said.

Mr Deane said he wouldn’t be opening Deanes Deli on Bedford Street again and having to pay back loans with added interest has sealed the deal on the south Belfast venue remaining shut.